Are you overwhelmed by the financial aspects of your business’s online presence? One of the most important aspects that are vital to success for every online shop is having a bookkeeping system which accurately tracks and follows up on all sales, payments received, costs incurred and taxes due. When it comes to accounting reports, filing tax returns at the end each year and tracking the flow of cash, bookkeeping can be highly beneficial.

The success of ecommerce businesses requires more than good products and good marketing strategies. In the background, precise financial management plays a vital role in ensuring profits and compliance. This article will focus on the most crucial aspects of finance in ecommerce, such as bookkeeping, accounting, and tax preparation. Understanding and mastering this area is crucial for sustained expansion in the ecommerce market.

Bookkeeping is essential to the management of finances for e-commerce businesses. It is the process of the recording and organization of financial transactions such as expenditures, sales, and inventory. Through keeping accurate and up-to date data, entrepreneurs of e-commerce gain valuable insights into their company’s financial health. By keeping accurate records online entrepreneurs can monitor their cash flow, sales, and expenses and make informed business decisions. For more information, click ecommerce

Achieving effective bookkeeping procedures is vital for businesses that sell online of all sizes. Here are a few key ways to streamline your bookkeeping process:

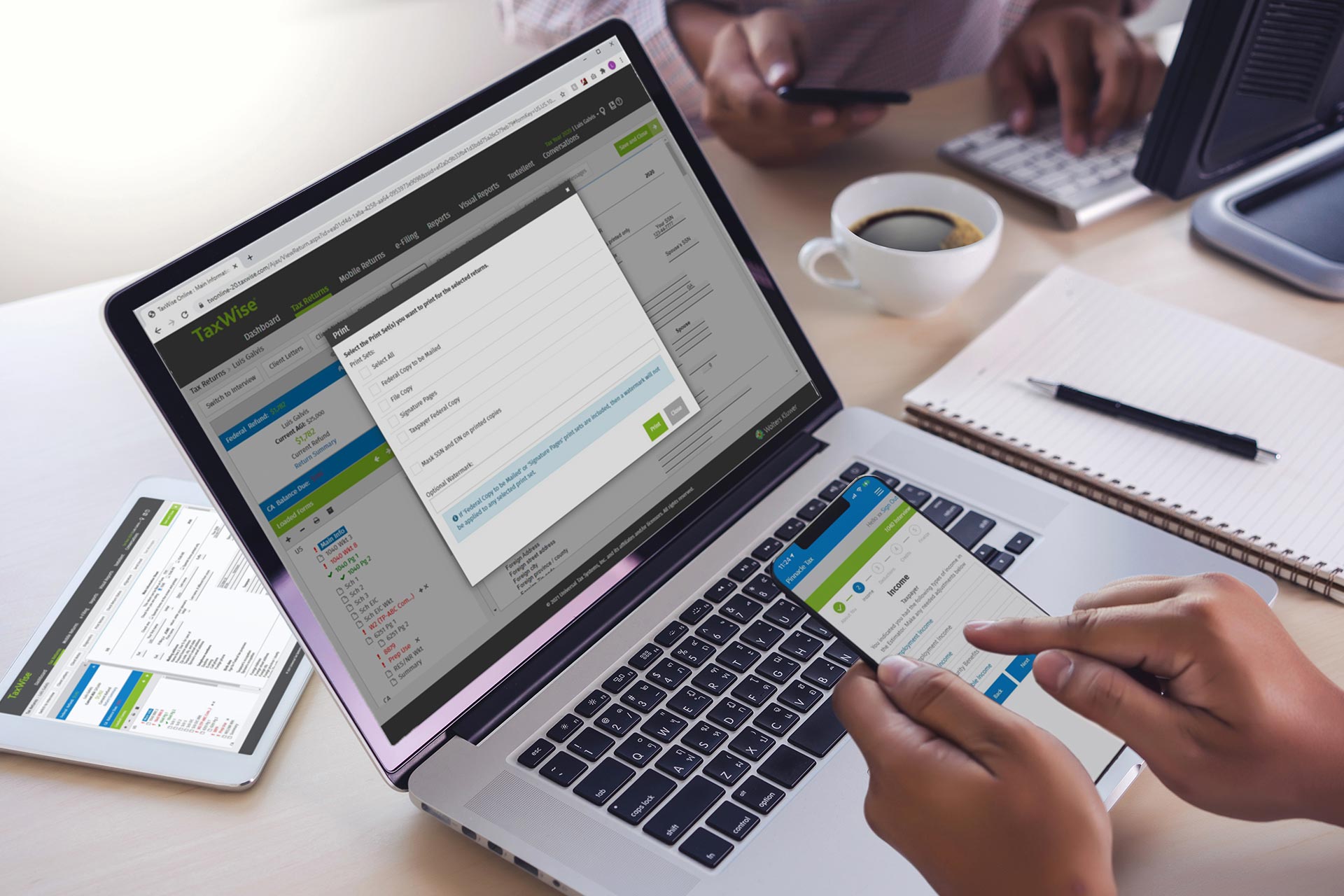

Accounting Software Use accounting software specifically designed for e-commerce. These tools automate the process of entering data, generate reports, and also provide integrations with payment gateways and other platforms.

Separate your personal finances from the ones of your company. It is essential to keep separate account for bank and credit card as well as debit cards. This will streamline your bookkeeping, simplifies tax preparation, and ensures accurate financial reporting.

Organise your transactions according to categories The ability to have a complete understanding of your revenue and expenses streams is easier when they organize them in a systematic way. Set up specific categories for sales shipping expenses, advertising costs, and any other relevant expense types.

Tax preparation is a key aspect of managing finances in eCommerce. E-commerce companies are required to follow tax regulations and collect and remit sales tax, if appropriate. They are also required to file accurate tax returns. Here are some considerations to ensure tax preparation is efficient:

Sales Tax Compliance: Know the requirements for sales tax in the jurisdictions where you market your goods. Find out if you have established nexus (a substantial presence) in these states and whether you need to pay sales tax and then remit it.

Keep Detailed Records: Keep precise records of expenses, sales, as well as tax-related transactions. This includes any documentation regarding exemptions or deductions you may be eligible for.

Contact a tax professional Taxation for eCommerce can be complex. Consider consulting a tax professional who is specialized in ecommerce companies to ensure accuracy and compliance tax preparation.

Accounting extends beyond the bookkeeping and preparation of taxes. It includes analyzing financial information, generating financial reports, and providing an overall picture of your company’s financial performance. Here’s the reason accounting is so important:

Accounting: You may use accounting to analyze the financial performance of your e-commerce company, identify patterns, determine profitability, and make informed growth decisions.

Budgeting forecasting, budgeting, and financial Goals Accounting lets you make budgets and establish financial goals, as well and forecast performance for the future. This lets you organize your time and resources effectively.

Financial Reporting: Creating financial statements, such as income statements, balance sheets, as well as cash flow statements lets you reveal your business’s financial status to stakeholders, investors, and lenders.

The process of managing financial tasks can become complicated as your business grows. Outsourcing accounting and bookkeeping services can bring many advantages.

Expertise and accuracy Accounting and bookkeepers who are professionals specialize in ecommerce finances providing accurate and precise records as well as financial statements.

Time and money savings by outsourcing your financial services, you are able to focus on the essential aspects of your company while experts manage them. Outsourcing can be cheaper than hiring employees internally.

The profits of your e-commerce website is enhanced when you have a good bookkeeping system in place. Even though it can be time consuming and intimidating to create the bookkeeping system, it allows you track your expenditure. You will also gain valuable insight on areas that can improve efficiency or increase sales. An accounting company that is professional can assist you in setting an effective bookkeeping system for your company. This will help to ensure that your company is in the best position for success. You can get help from a reliable service when you’re overwhelmed or do not have the resources to set up a system. The process could lead to many new possibilities that can improve your business in many ways right now as well as in the future. Why put off? Make use of these valuable tools today and use these to boost your company’s profit margins as never before!